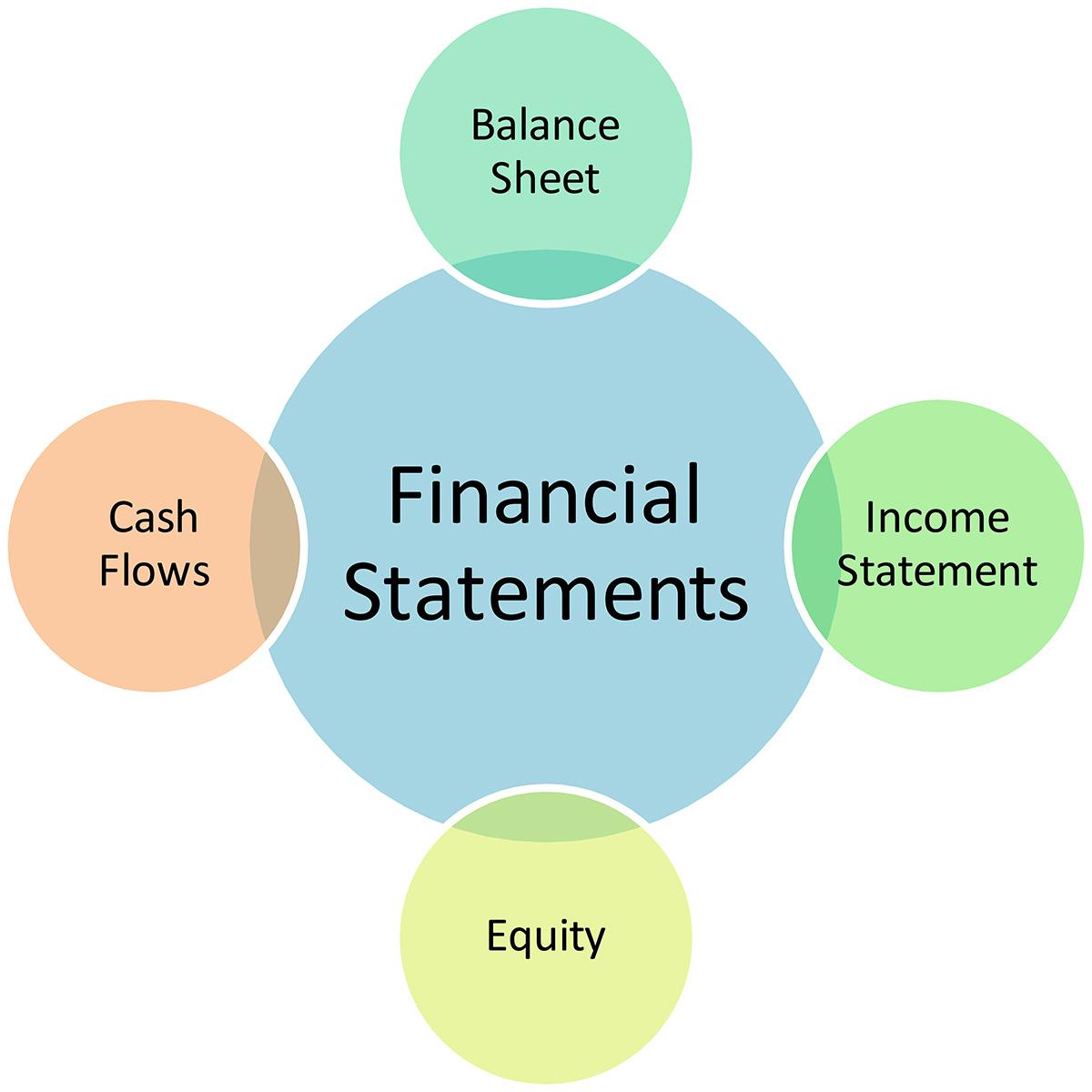

Financial Statements

If you are struggling to deal with calculating all of your company’s finances, don’t possess the necessary software or simply never have the time, Plan A can help you by producing all of the yearend statutory accounts that your business will need.

By outsourcing this service to our team, you can remove the hassle associated with it, as we can go through all of the company account records for you, as well as any bank statements, sales orders and purchase invoices.

Working out a firm’s finances can often be tricky. For example, your statutory accounts need to be filed with HM Revenue & Customs a year after your yearend date, but this is despite your corporation tax being due nine months after your company’s yearend. This can actually leave you in the position where your business tax is due but you don’t yet know the amount.

Luckily, our team can handle your company’s financials, so that you don’t have to pull your hair out.

Also, if a client is using the cloud-based accounting software Xero, we will aim to have your draft accounts ready for discussion and approval with one month until your yearend.

If our team is handling your yearend accounts by combing through your firm’s own records, we will aim to have readied all draft accounts only one month after all the relevant details have been received. We do so because it is better to have your accounts sorted sooner rather than later.

Along with saving you money, outsourcing your financial statements to Plan A also means we can get to them quickly, giving you a much better insight into your company’s performance.

End of year statutory accounts

- Abbreviated accounts for companies house

- IXBRL submission of accounts

- CT600 Filing