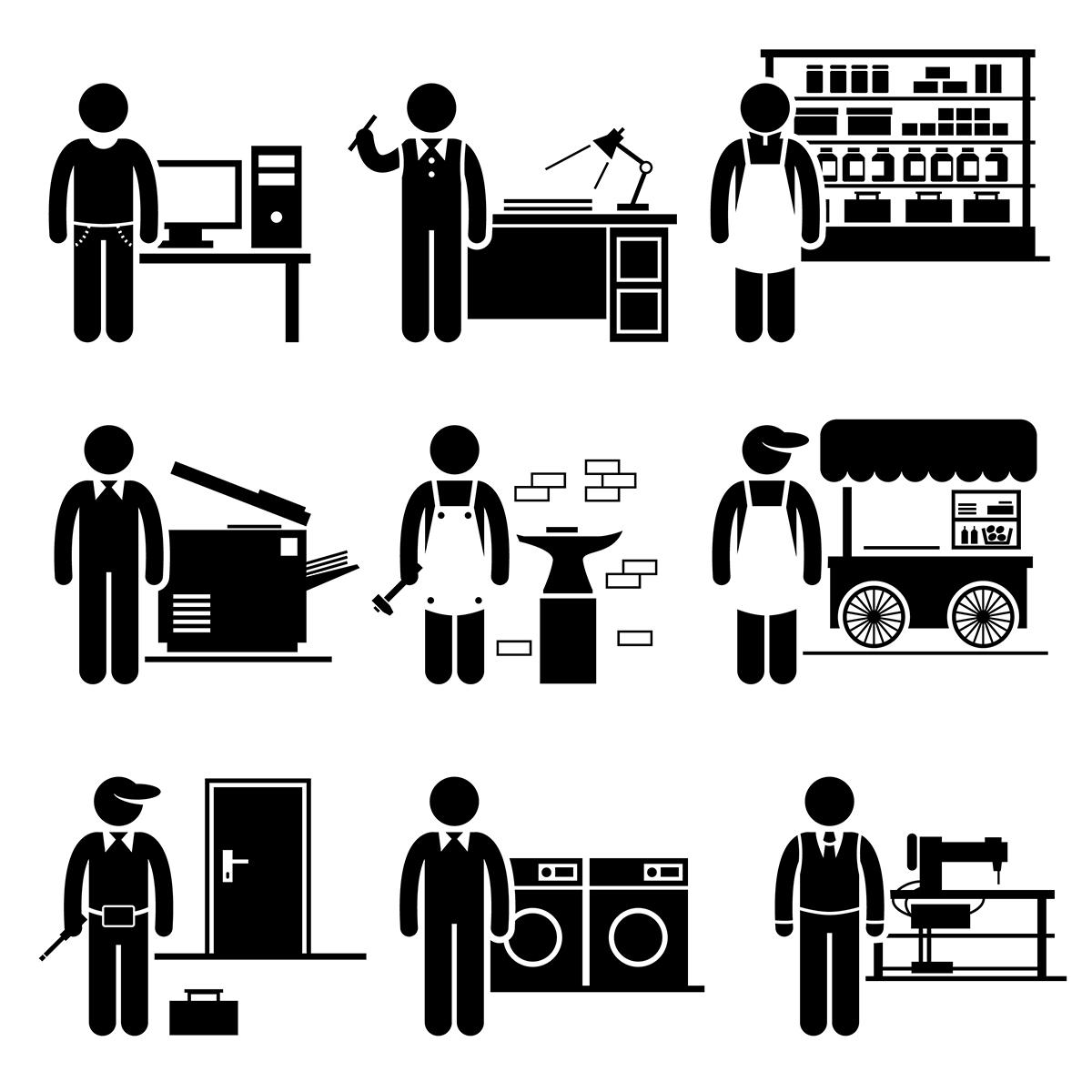

Sole Traders

A sole trader is a person who sets up and owns their own business. They may decide to employ other people but they are the only owner. A sole trader has unlimited liability.

As a sole trader, your business is owned entirely by you, grown by you and ultimately succeeds or fails by you. This also means you are entitled to all profit that the business makes.

You are also required to complete a self assessment and a key step in being able to do so is completing as a minimum a Profit and Loss account to incorporate into your self assessment.

As a sole trader you are entitled to claim a number of expenses if they are incurred wholly and exclusively for your business needs.

This may also included expenditure on items that used both for business and personally i.e. A motor vehicles and telephone, as such HMRC would expect you to make a fair adjustment to allow for personal use and as therefore is often a key point HMRC would examine in any investigation.

Some of the most famous entrepreneurs in the UK started out as sole traders. From Lord Sugar, who launched his first business with £100 selling aerials out of the back of a van, to Duncan Bannatyne, who started his entrepreneurial career with an ice cream van back in the eighties. This is why sole traders are often described as the forefront of UK Business growth.

Elements of Service

- Preparation and completion of P&L

- Capital allowance computations

- Calculation of tax and NI Liabilities

- CIS Refunds

Preparation & completion of P&L

- Capital allowance computations

- Calculation of tax and NI Liabilities

- CIS Refunds